How To Review Your Business Performance

Who is this for?

This is for you if you want to review your business performance regularly and identify ways to improve your business profitability and cash flow.

Note: The information contained herein is for guidance only and may change over time. You should always seek professional advice and support to ensure that it is most appropriate to you and your own individual circumstances.

Why review your past business performance?

It’s important to review your past business performance regularly so that you can identify what is going well and what isn’t. Looking at your past business performance will also help you to identify changes that you can make to improve your future performance.

Where do you start?

You can consider how your business is performing under four key areas:

- Sales (turnover)

- Costs

- Profit

- Cash flow

1. Sales (Turnover)

When you look at your past sales, consider it from a range of different perspectives such as:

- Increasing or decreasing

- Sales (product/service) mix

- Seasonality (peaks and troughs)

2. Costs

You can think of your costs in a number of different ways:

- Direct – those costs that you must pay to provide your product or service e.g. ingredients costs in a café/bar/restaurant; entrance fees or coach costs if you provide tours of buildings or travel for your customers.

- Indirect – those costs that generally form part of your expenses but are not attributable to your products or services directly e.g. insurance; telephone costs; rent

- Controllable – these are costs that you can have at least some control over e.g. supplier costs; staff wages; marketing.

- Uncontrollable – these costs are generally fixed, and you don’t have much control over them on an ongoing basis e.g. rent/rates; taxes; loan interest.

3. Profit

Be clear about the profit you can generate:

- Gross profit – described as the sales revenue less the cost to make a product e.g. the sales price of a bottle of craft beer or cider, less the direct cost of making it.

- Net Profit – the sales revenue less all of the costs incurred by the business. This is what is used to calculate any liability for income or corporation tax.

Look at your past profit and decide if it is sufficient for the risks you are taking, for the time you spend and for the investment you have made as a business owner.

4. Cash flow

- Cash flow is critical and even though you are making a profit, you need to consider when and how the cash flow operates in your business – remember that cash, not profit pays your bills.

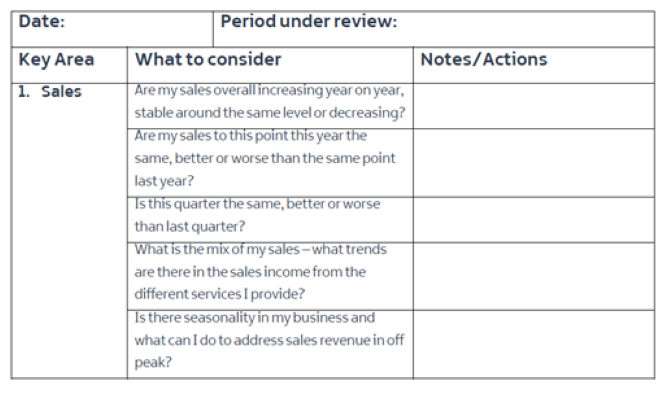

Business Performance Checklist

You can use the Business Performance Checklist to help you to do this, remembering that you should be watching out for actual figures and also trends.

Click image to download 'Business Performance Checklist'