Choosing and using the right bookkeeping system

Who is this for?

This is for you if you want to set up a formal bookkeeping system for your new business or improve the system you already use.

Note: The information contained herein is for guidance only and may change over time. You should always seek professional advice and support to ensure that it is most appropriate to you and your own individual circumstances.

What is bookkeeping for?

Bookkeeping is the systematic recording and organising of financial transactions in a business.

Bookkeeping provides the information from which accounts are prepared that will ensure tax returns can be completed. It’s a distinct process, that occurs within the broader scope of accounting.

Accurate recording on a day-to-day basis ensures that records of the individual financial transactions are correct, up-to-date and comprehensive.

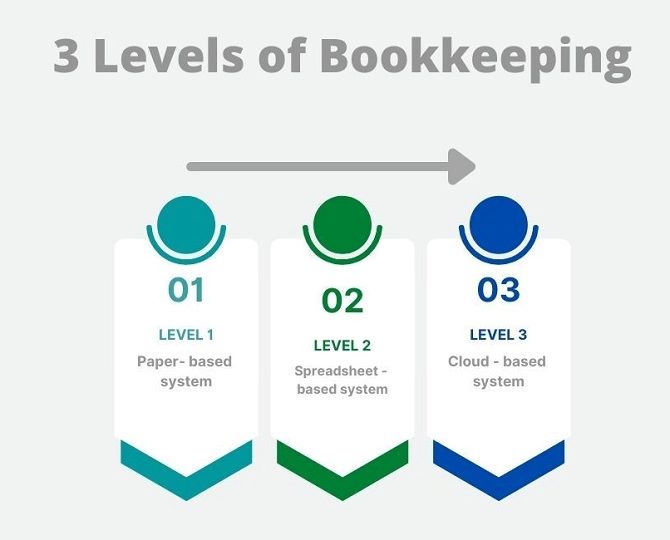

3 Levels of Bookkeeping

There are generally 3 levels of bookkeeping that you can adopt to ensure that you keep adequate records:

Level 1: Paper-based system

Many businesses start off with basic paper records and these can be adequate in the early days of the business, especially when there are few transactions. This usually involves preparing handwritten or word-based invoices and keeping paper copies of receipts.

This has a very low cost in terms of outlay however it only provides the minimum required for tax and other records. It provides little or nothing by way of management information on business trading.

When Making Tax Digital (MTD) starts for sole trader businesses from April 2024, this will not be sufficient to meet the requirement of digital records for HMRC purposes.

Level 2: Spreadsheet-based system

A spreadsheet-based system takes your bookkeeping to the next level by automating some of your records. You can get some spreadsheet systems that are based on recording the business details in columns and rows so that it adds up your income or specific categories of expenses.

This does provide some level of automation and certain trading information by tracking income and expenses in categories. It can reduce the time you spend on your records, and it can also prepare information that will be useful for your year-end tax returns.

It may be able to meet the requirements of Making Tax Digital in 2024 if used along with what is known as “Bridging Software”. You should speak to your accountant about this.

Level 3: Cloud-based system

This is the ideal system to use if you want to make your bookkeeping work for you and save you valuable time at the end of the year when your tax return is due. Whether you prepare your own or you have an accountant who does that for you.

Now there are also packages that are not cloud-based but they do provide you with a full automated bookkeeping system – for those who don’t quite trust the cloud and would rather have the information just stored locally on their computer.

So, what do they do for you and your business?

Well, here are just some of the features:

- It links to your bank account in real time, so transactions are automatically imported into your bookkeeping system without the need for inputting each one

- You can design your own invoice and estimate templates, add your logos and other details to make your business look more professional

- You can produce regular trading reports such as Profit & Loss accounts to see how your business is performing

- You can keep track of unpaid invoices and send out statements and reminders to your customers

- You can automate your VAT returns if you are registered

- It meets Making Tax Digital requirements

- Your data is backed up automatically in the cloud

- There are associated apps that allow you to snap and store receipts and manage your bookkeeping on the go

It is also worth noting that some people are still unsure about the cloud from a security perspective and that is something you can decide. Also you will need internet availability to access the cloud, so if you have a poor reception, then this will be a factor.

Which cloud-based system to choose?

There are many options to choose from, offering different features and benefits, different pricing packages and user experiences. Just some of these are:

- QuickBooks Online

- Xero

- Sage

- Clear Books

- FreeAgent (currently free to Ulster Bank business customers)

There are many more of these and there are also free versions like QuickFile, which may have less features but is free.

In truth, there will be trade-offs between each one, however they all complete the same general functions, it just will look a bit different.

Generally speaking you should ask other business owners preferably in similar business to yours and see what they use and what they think of it.

You can also check online reviews and you should check with your own accountant as they can have their own preferred bookkeeping software systems.

Conclusion

Each business is different and like everything you will have to weigh up and consider what is right for you and your business.

Cloud-based systems do make bookkeeping more user friendly and accessible to owners who want to take greater control over their finances. And the choice is good but up to you as an owner as to what is best for you.